PPP Loan Forgiveness: What Everyone Needs to Know

By Bruce L. Blasnik, CPA, CGMA, Partner

Based on the questions we’ve been getting regarding PPP loan forgiveness, it is clear that many people do not understand the purpose of the CARES Act Payroll Protection Program. The PPP is intended, first and foremost, to keep people on your payroll – whether you need them or not – and out of the unemployment lines. PPP loans do provide some limited support for non-payroll needs such as covering essential fixed costs to, literally, keep the lights on. But, if you do not maintain both your salaries and headcount at pre-pandemic levels, you will not maximize forgiveness of your PPP loan. It is really that simple.

Do What Is Best for Your Business

For many businesses, maximizing loan forgiveness is not what is most important. Rather, you should be focused on making sure your business survives, even thrives, over the long-term. If you can afford to use the PPP loan to keep your people employed for 8 weeks, even though you don’t need them all, then by all means, do so. But if your business is likely to struggle beyond the 8-week forgiveness period, perhaps you are best foregoing some forgiveness in order to provide needed working capital during a prolonged recovery period. After all, what’s the point of spending all the money in 8 weeks only to find you can’t make it through the 3 months after that? While some of the PPP loan will need to be paid back, it’s a 1% loan. That’s pretty cheap capital.

It’s Much Better to Reduce Pay than to Reduce Headcount

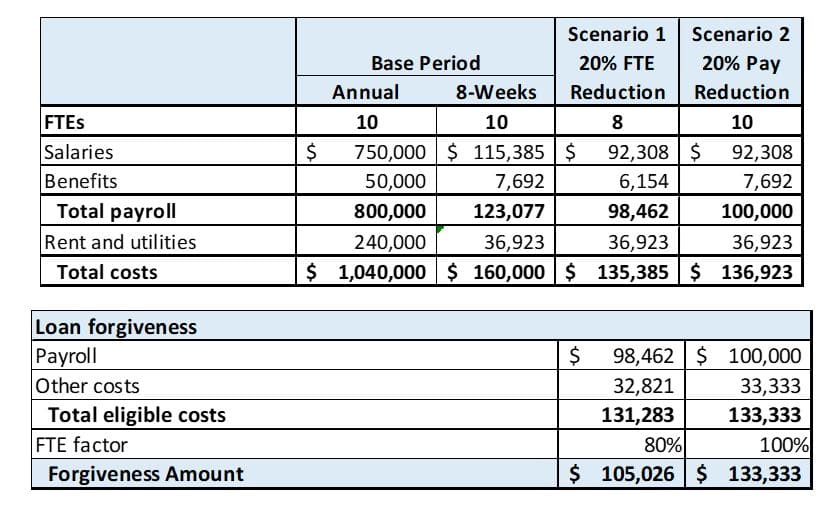

As long as pay reductions are limited to no more than 25% for any individual employee, it’s better to reduce pay than headcount. Consider this simple example. Company A has 10 employees, each earning $75,000. Group health and retirement benefits add another $5,000 per employee, or $50,000 for the year. Further assume that Company A has $20,000 a month in rent and utilities. In the table below, we compare two alternatives, both of which have nearly identical out-of-pocket costs. In the first scenario, Company A reduces its headcount by 20%. In the second scenario, they retain all their employees but reduce salaries by 20%. In the second scenario, loan forgiveness is over $28,000 greater than in the first scenario.

One Last Thought

If you run through the math, you’ll find that you cannot qualify for full forgiveness – you fall short by 1 or 2% – unless you increase salaries and/or headcount. Some companies we have spoken with are considering reducing headcount but using the loan proceeds to pay or accelerate bonuses, enhance current salaries, or buy back unused PTO. As far as we are aware, the Act does not explicitly prohibit these things; however, we advise against it. It is the clear intent of the Act that the PPP funds be used to retain workers and maintain payroll, and not to expand staffing or increase payroll. Doing the latter could result in penalties, including having to repay the full amount of the loan, or worse.

Contact Us

As always, if you need any assistance, please reach out to your PKF O’Connor Davies client service team or Bruce L. Blasnik, CPA, CGMA, Partner at CLT-SBATechnical@pkfod.com. We are here to help.