SBA Releases Additional Guidance

Related to Owner Compensation and Certain Nonpayroll Costs, Including Related Party Rents

By Bruce L. Blasnik, CPA, CGMA, Partner

Last night, August 24, 2020, the U.S. Small Business Administration (SBA) released an interim final rule (IFR) entitled Treatment of Owners and Forgiveness of Certain Nonpayroll Costs. This IFR contains important guidance on pending questions related to certain Paycheck Protection Program (PPP) loan expenses eligible for forgiveness.

Owners

This IFR states that “owner-employees with less than a 5 percent stake in a C- or S- Corporation are not subject to the owner employee-compensation rule.” Based on this guidance, one can further assume that a general partner with any ownership interest is an owner. Prior guidance provides complex and confusing rules limiting the compensation of owner-employees without defining who was subject to the owner-employee rules, so this new IFR is welcome guidance indeed.

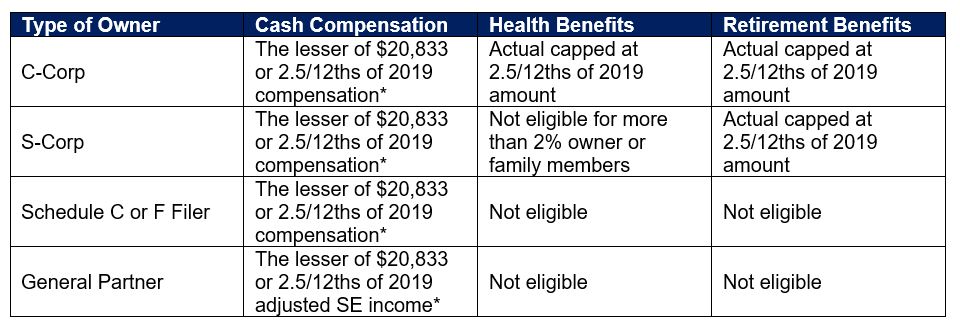

The complex rules covering owner-employee compensation eligible for forgiveness can be summarized as follows:

* For borrowers that received a PPP loan before June 5, 2020 that elect an 8-week Covered Period, the cap is the lesser of $15,385 or 8/52nds of 2019 compensation. Also, we believe that the caps must be pro-rated for borrowers electing to file their forgiveness applications before the 11th week after their loan date.

Further Clarification Still Needed

While this IFR is a big step forward in clarifying who qualifies as an owner, in what has become par for the PPP, we are still left with at least one very significant unanswered question: Does ownership attribution of close family members apply in defining who is an owner-employee? For example, if a business owned by one spouse employs both spouses, is the non-owner spouse treated as an owner for PPP purposes? (The same question applies to the children of owners.)

We also have a new question related to the eligibility of health benefits of S-Corp owners with between 2 percent and 5 percent ownership; although this concern has very narrow applicability.

Related Party Rents

Whether or not limitations apply to related party rents has been a significant unanswered question for many PPP borrowers. This IFR provides the long awaited guidance by limiting the amount of loan forgiveness requested for rent or lease payments to a related party to “no more than the amount of mortgage interest owed on the property during the Covered Period” to the space being rented by the business, assuming both the lease and the mortgage were entered into prior to February 15, 2020. For this purpose, “any ownership in common” between the business and the rented property creates a related party lease.

By looking through the lease and treating the lease payments as payments of mortgage interest, this ostensibly eliminates the eligibility of prepaid related party rents since prepaid mortgage interest is not eligible for forgiveness. This is an important consideration for some business owners, particularly those that have endured significant reductions in their workforce.

Certain Other Nonpayroll Costs

This IFR also limits the amount of rent, interest and utility costs that are eligible for forgiveness where some or all of the property on which the rent, interest or utilities are being paid is leased or sub-leased to others. So, for example, where a borrower rents an office for $10,000 a month and subleases a portion of the office for $2,500 a month, only $7,500 per month is eligible for forgiveness.

When a borrower operates out of an owned building on which it has a mortgage, the eligible mortgage interest is limited to the percent share of the fair market value of the space that is not leased out to other businesses. Utilities must be prorated in the same manner.

For home-based businesses, nonpayroll costs are limited to the prorated share of covered expenses that were deductible on the borrower’s 2019 tax return; or, if a new business, the amount expected to be deductible on the borrower’s 2020 tax return.

Contact Us

For assistance in understanding these and any other rules related to the PPP, please reach out to your PKF O’Connor Davies team members, or email us at LoanForgiveness@pkfod.com. We are here to help.