Key Takeaways

- Mergers and acquisitions activity in North America rose 6.9% in the first quarter of 2025 compared with the same period in 2024, supported by favorable market sentiment and investor optimism.

- The deal environment shifted abruptly in April as increased tariffs and unclear trade policies introduced new economic uncertainty, slowing activity in the second quarter.

- Positive market drivers remain in place despite recent volatility, including record levels of dry powder, corporate cash reserves and continued generational ownership transitions.

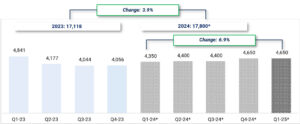

M&A transaction volume in North America for the first quarter of 2025 after all deals are reported is expected to be approximately 4,650. This reflects a 6.9% increase over the comparable period in 2024 and is in line with the strong last quarter of 2024.

The robust M&A activity observed in the first quarter aligned with the positive market sentiment and expectations by market participants that 2025 would be a very active year for M&A deals. This outlook was supported by a new, business-friendly administration and Congress, abundant capital available to financial and strategic investors, expected lower interest rates and reduced government regulation. We’re also seeing continued exits by baby boomers and renewed appetite from financial sponsors to realize past investments and identify new platform opportunities.

Quarterly M&A Transaction Volume (Deal Count) in North America

Source: PitchBook and PKF Investment Banking research

* Note: Projected deal count based on data as of April 30, 2025

April Market Change

The deal environment changed swiftly in April, with an abrupt dynamic continuing into May and moderating in June. Elevated levels of uncertainty and lack of visibility surged almost overnight, fueled by increased tariffs and ever-changing and unclear trade policies, which heightened the risk of higher inflation and recessionary concerns and further clouded the timing of interest rate reductions. A volatile stock market and lower consumer confidence levels also contributed to an overall choppy M&A environment.

The impact we are seeing on the M&A market can be summarized as follows:

- Lack of clarity regarding future performance, especially for companies with complex supply chains.

- Slow down in deal closings in the second quarter.

- Pause in certain deals in the market (unclear tariff impact).

- Delay in certain deals going to market (unclear revenue visibility).

- Elongated due diligence periods by buyers and lenders.

- Tighter credit markets.

- Increased inclusion of earn-out structures as a component of purchase price consideration.

Aside from the considerations above, the magnitude of the impact (if any at all) remains sector- and/or asset-dependent. Sectors with no or minimal tariff exposure, boasting clear revenue visibility or possessing recession-resistant attributes enjoy healthy and sustained deal activity. Examples of such sectors include (tech-enabled) business services, financial services, aftermarket services, health care, software-as-a-service (SaaS) and heating, ventilation and air conditioning (HVAC).

There remains a shortage of “A-quality” companies available for sale to serve as platforms for financial sponsors, while those in the market command very strong valuations. Numerous financial sponsors recently conveyed that they had not been invited to management meetings after submitting a strong first-round bid.

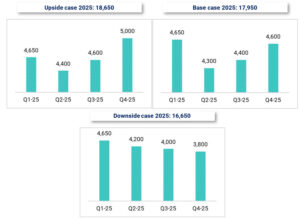

Possible Scenarios for the Remainder of the Year

We expect second quarter deal volume to decrease by five to 10% from the first quarter. The outlook for the third and fourth quarters remains largely uncertain and contingent upon clarity around trade policy, inflationary pressures, economic activity and interest rate trajectory over the next several months. The scenarios below are not true projections but possibilities for the rest of the year. The downside case reflects trade policies remaining uncertain past the summer, coupled with further heightened recessionary concerns. Conversely, the upside case would be more likely if uncertainty levels subside and recessionary concerns retract by September.

Positive Market Drivers

Looking ahead, several factors that may positively affect M&A activity levels in the U.S. encompass:

- $1.4 trillion of dry powder (see chart below).

- $3.5 trillion of cash on hand by U.S.-based, non-financial corporations.

- 12 million privately held businesses owned by baby boomers.

- Pressure on private equity (PE) firms to return capital to their limited partners (see increased holding periods in the chart below).

- Expected government deregulation.

- Expected interest rate reductions.

Source: CapitalIQ

*Note: Others include – Balanced, Co-Investment, Co-Investment Multi-Manager, Direct Secondaries, Fund of Funds, Junior / Subordinated Debt, Mezzanine, Private Debt Fund of Funds, Special Situations, Turnaround

Looking Forward

We remain cautiously optimistic that the actual deal volume trend for the remainder of the year will be more in line with the base case or upside case.

Contact Us

The PKF Investment Banking team is available to discuss current M&A dynamics and determine which opportunities may exist for your business. For more information, please contact:

- Robert Murphy

Senior Managing Director

PKF Investment Banking

rmurphy@pkfib.com | 561.337.5324 - Alberto Sinesi

Director

PKF Investment Banking

asinesi@pkfib.com | 203.273.5024

About PKF Investment Banking

PKF O’Connor Davies Capital LLC (DBA PKF Investment Banking) is a subsidiary and investment banking affiliate of PKF O’Connor Davies Advisory LLC. Securities-related transactions are processed through an unaffiliated broker-dealer, Burch & Company, Inc.

Whether a business owner is ready to sell the company or seeking growth through acquisition, our investment banking team is committed and credentialed to help owners achieve their objectives. PKF Investment Banking provides guidance through every step of the process and brings the expertise to enhance certainty to close – while always staying focused on maximizing the value derived from the transaction.

With deep expertise in and a dedicated focus on advising privately held middle-market businesses, the PKF Investment Banking team has completed over 300 M&A and capital raise engagements in North America and abroad during their careers. Our key services include sell-side and buy-side M&A advisory, exit readiness and transaction planning. For more information, visit www.pkfib.com.

PKF Investment Banking provides this report for information purposes only and it does not constitute the provision of financial, legal or tax advice or accounting or professional consulting services of any kind.