By Jonathan Zuckerman, CPA, Partner and John M. Haslbauer, CPA, Partner

The Securities and Exchange Commission (SEC) recently issued two proposed amendments:

- a proposed rule change to amend disclosure requirements for acquisitions and dispositions of businesses; and

- a proposal amending the definition of accelerated and large accelerated filers.

Both proposals are subject to a 60-day comment period following their respective publication in the Federal Register.

Financial Disclosures Relating to Acquisitions and Dispositions of Business

The proposed amendment would impact the financial disclosure requirements in Rules 3-05, 3-14 and Article 11 of Regulation S-X, as well as related rules and forms, for financial statements of business acquired or to be acquired and for business dispositions. The proposed changes are intended to improve for investors the financial information about acquired and disposed businesses, facilitate more timely access to capital, and reduce the complexity and cost to prepare the disclosures.

The proposed amendments include:

- An update to the significance test by revising the investment and income tests as well as expanding the use of pro forma financial information in measuring significance. Registrants would consider their market capitalization in the investment test and both their revenue and after-tax income in the income test.

- Require the financial statements of the acquired business to cover up to the two most recent fiscal years rather than up to the three most recent fiscal years under current rules.

- Permit the use in certain circumstances of, or reconciliation to, International Financial Reporting Standards as issued by the International Accounting Standards Board to accounting principles generally accepted in the United States of America.

- Replace the requirement that registration statements include financial statements and pro forma financial information for the “mathematical majority” of the acquisitions that are significant in the aggregate with a requirement that they include only the financial statements of those acquisitions that individually exceed 20% significance, along with pro forma financial information about the aggregate effect of all acquisitions, in all material respects.

- The significance threshold for reporting a Registrant’s disposal of a business and related pro forma information would increase from 10% to 20%.

- Expand use of abbreviated financial statements to address acquisitions of partial components of companies.

- Make corresponding amendments to the financial disclosures of smaller reporting companies and investment companies.

For a complete version of the rule proposal issued on May 3, 2019, click here: Amendments to Financial Disclosures about Acquired and Disposed Businesses.

Accelerated Filer and Large Accelerated Filer Definitions

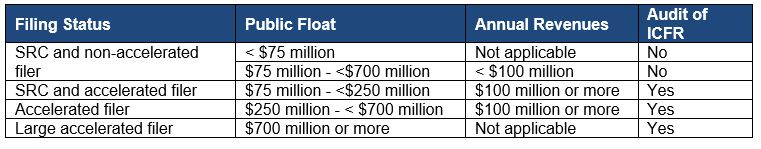

The SEC proposed amending the definitions of an accelerated filer and a large accelerated filer to exclude smaller reporting companies (SRC) that have not yet begun to generate significant revenue. The proposed amendments include the following:

- Exclude from the accelerated and large accelerated filer definitions an issuer that is eligible to be an SRC and had no revenues or annual revenues of less than $100 million in the most recent fiscal year for which audited financial statements are available.

- Increase the transition thresholds for exiting accelerated and large accelerated filer status from $50 million to $60 million (accelerated to non-accelerated) and $500 million to $560 million (large accelerated to accelerated).

- Add a revenue test to the transition thresholds for exiting both accelerated and large accelerated filer status.

The impact for issuers that become non-accelerated filers, as well as for SRCs with less than $100 million in revenues, would result in extended filing deadlines and no longer be required to obtain an annual attestation on internal control over financial reporting (ICFR) from their independent registered public accounting firm.

A summary of the proposed amendments to filing requirements are as follows:

For a complete version of the rule proposal issued on May 9, 2019, click here: Amendments to the Accelerated Filer and Large Accelerated Filer Definitions.

Contact Us

If you have any questions about these new proposed rules applicable to SEC-regulated companies – or any other accounting and auditing matters – please contact either of the following partners or the partner in charge of your account:

Jonathan Zuckerman, CPA

Partner

jzuckerman@pkfod.com | 646.699.2842

John M. Haslbauer, CPA

Partner

jhaslbauer@pkfod.com | 646.699.2838