By Sandy Weinberg, JD, Principal

Those in the businesses of pharmaceuticals, software, and chemicals seem to know that the federal research tax credit is available to their industries. They know that state research credits are available too.

But in other industries, the secret is not out. For example, some businesses in the manufacturing, healthcare, architecture, construction, retail, and engineering industries conduct R&D activities and have opportunities to capture the research credit. But they do not all seek the savings.

Examples of eligible opportunities abound. In the architecture industry, designing and developing unique building systems or developing improved energy-efficient components for commercial structures may be qualified research. In the construction industry, designing new and efficient HVAC or developing innovative and improved building structures may be qualifying research. In retail, developing new methods for loss prevention and fraud detection or developing eco-friendly clothing may also qualify.

All industries conducting qualifying research can take advantage of increased research credit amounts triggered by the Tax Cuts and Jobs Act (TCJA) which are discussed below.

New Research Credit Benefits

In 2018, the changes under the TCJA became effective. Congress did not modify the research credit as part of the TCJA, but the reduction of the corporate tax rate from 35% to 21% indirectly increased the value of the research credit for both corporate and non-corporate taxpayers. Those who filed their 2018 returns taking the research credit ‒ and filed after seeking an extension ‒ first noticed the increased credit amount this autumn.

The increased benefit occurs when taxpayers elect the reduced credit under IRC Section 280C(c)(3). The election’s primary purpose is to eliminate the need for taxpayers to make an addback of research expenses to taxable income (which generally increases state taxes).

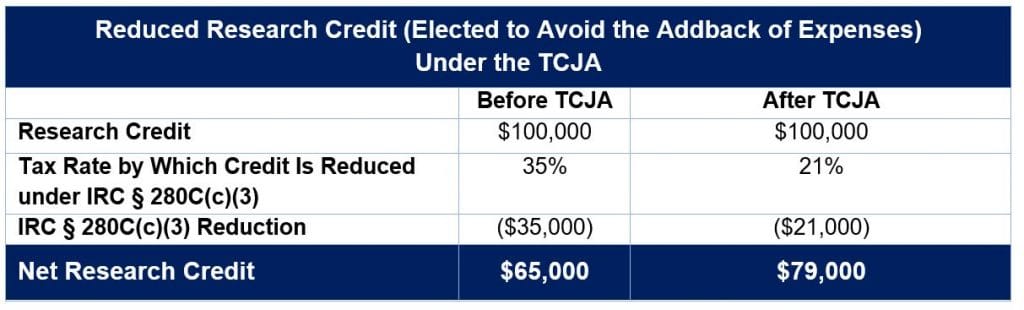

Before the TCJA, taxpayers making the IRC Section 280C(c)(3) election had to reduce their research credit by 35%. As a result, taxpayers claiming the reduced credit only recognized a tax credit benefit that equated to 65% of the pre-election credit. Following the TCJA, taxpayers must reduce claimed credits by only 21%. Therefore, taxpayers recognize a benefit that equates to 79% of the pre-election credit.

The value of the law change is reflected in the following example:

The TCJA also expanded the availability of the research tax credit for certain taxpayers. For corporate taxpayers, it eliminated the alternative minimum tax (AMT). For individual taxpayers, the TCJA increased the AMT exemption amount. This favorable change will apply from 2018 to 2026. The AMT had been a hurdle that previously prevented some taxpayers from using the research credit. (The Protecting Americans from Tax Hikes Act of 2015 previously eliminated this limitation for corporate and non-corporate taxpayers with average annual gross receipts of $50 million or less for the three tax years preceding the credit year.)

New Research Credit Limitations

The TCJA, however, does contain some research credit limitations. Significantly, the credit (and other General Business credits) can be used to offset up to $25,000 of tax and only up to 75% of any tax above $25,000. Further, for tax years beginning after 2021, the TCJA eliminates the option to deduct R&D expenditures currently and requires taxpayers to charge them to a capital account and amortize them over five tax years, beginning with the midpoint of the tax year in which the specified research expenditures are paid or incurred.

Takeaways

Those who think their company may be eligible for the research credit should:

- Contact a research credit specialist. A five-minute conversation will lead you in the right direction.

- If eligible for the research credit, estimate the current year benefit and any open prior year benefits that have not been taken. [Note, that for prior years, because the IRC Section 280C(c)(3) election cannot be made, there may be some additional state tax, interest, and penalties which can offset some of the federal tax benefit.]

- If the benefit is significant, and the cost and time commitment worthwhile, conduct a research credit study to capture all of the eligible qualifying expenses, ensure that the research projects qualify, and compile all proper documentation including project narratives and contemporaneous written information.

Contact Us

If you have any questions regarding research credits, or wish to have a research credit study performed, contact:

Sandy Weinberg, JD

Principal

sweinberg@pkfod.com | 203.705.4170

Jill Cantor, JD, CPA

Senior Manager

jcantor@pkfod.com | 203.705.4174

Austin Legenos, JD

Manager

alegenos@pkfod.com | 203.705.4123