By Jon Klerowski, CPA, CFE, ABV, Principal and Brian McDonough, CPA, CFE, Manager

International Fraud Awareness Week (Fraud Week), a worldwide event established by the Association of Certified Fraud Examiners (ACFE), is meant to promote the safeguarding of businesses and investments and to proactively fight fraud.

As part of our role in helping organizations prevent, deter and detect fraud, our forensic accounting professionals weigh in on the highlights of the ACFE’s 2022 Report to the Nations (2022 RTN)*. The report contains the results of a comprehensive study of the costs, methods, victims and perpetrators of occupational fraud. The study, encompassing 2,110 cases across 133 countries, gathered data regarding occupational fraud cases that companies investigated around the world from January 2020 through September 2021. Based on the results of the report, it is estimated that the average organization loses 5% of their revenue to fraud each year! To repeat: that is FIVE PERCENT of top-line revenue!

Corruption: Most Common Scheme

There are three main categories of occupational fraud: asset misappropriation, corruption and financial statement fraud. Each consists of numerous types of schemes. Unfortunately, all organizations can be victims of fraud, no matter the size (large or small) or type (private, public, nonprofit, or government entities). There are certain trends in larger organizations: corruption and misappropriation of non-cash assets are twice as common in occupation fraud in large organizations with greater than 100 employees; however, these schemes can still occur in smaller organizations.

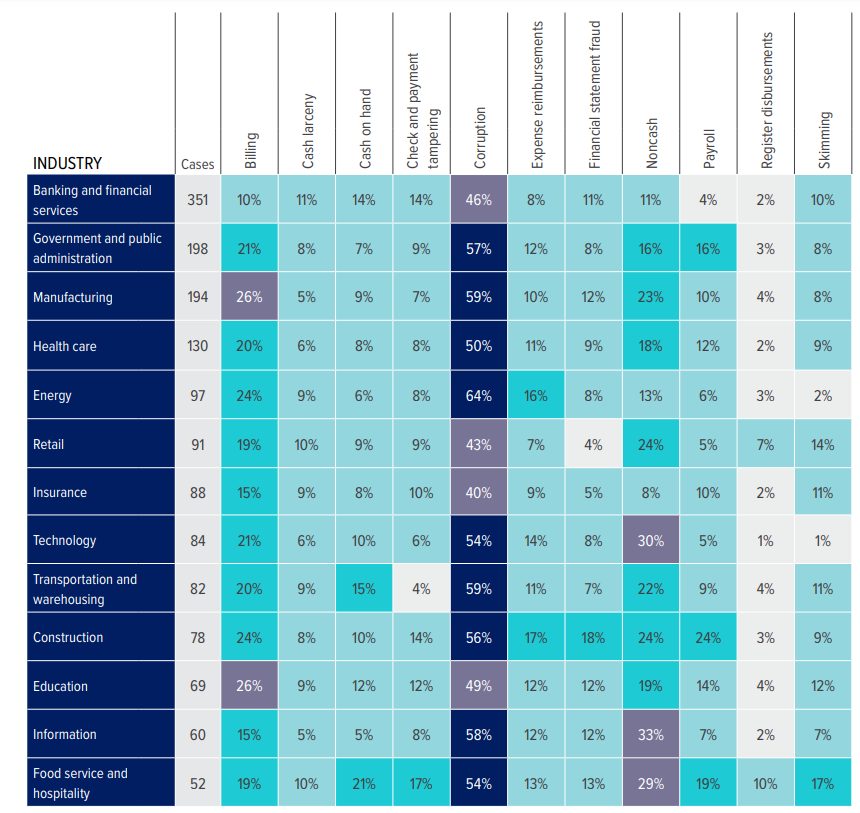

What are the Most Common Occupational Fraud Schemes in Various Industries

Anyone Can Commit Fraud

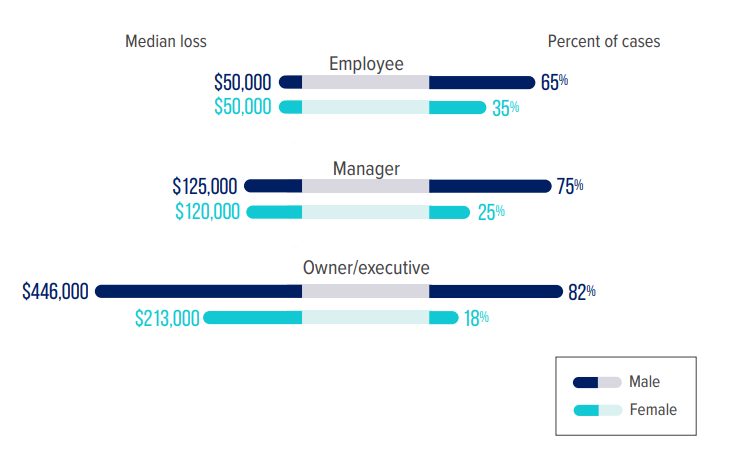

The 2022 RTN noted fraud is perpetrated by individuals across a broad spectrum of age, tenure, education level, position and department. Some notable data points include:

- Men are far more likely to be the culprit (73% of incidents) and

- Higher levels of authority equate to a higher median loss incurred.

How do Gender Distribution and Median Loss Vary Based on the Perpetrator’s Level of Authority?

In 85% of cases, perpetrators of fraud displayed at least one of the most commonly identified red flags. The most common perpetrator traits that companies should look out for include: living beyond means (39%) and having financial difficulties (25%). Other common red flags to look out for involve:

- Unwillingness to share duties

- Unusually close association with vendors or customers

- Bullying or intimidation

- Complaints about inadequate compensation

- Refusal to utilize paid time off

Effective, Low-Cost Fraud Controls

There are some highly effective, low-cost measures that any organization can take to detect, prevent and minimize the cost and duration of fraud. Examples include:

- Hotline

- Written Code of Conduct

- Mandatory rotation, mandatory time off

The most common detection method for uncovering fraud in an organization is a tip off that it may be occurring (42% of cases). Employees provided more than half of all tips; however, customers and vendors provided another quarter. Thus, having a process in place like a hotline to collect tips from both inside and outside of your organization is imperative but, in order to be effective, organizations must also educate employees and vendors about its existence to utilize it. Hotlines were in place at 70% of victim organizations. Organizations without hotlines incurred median losses of $200,000 ‒ twice that of organizations with hotlines.

Other common anti-fraud controls implemented by organizations include:

- External audit of internal controls over financial reporting

- Management review

- Internal audit department

Internal Audit and Data Analytics

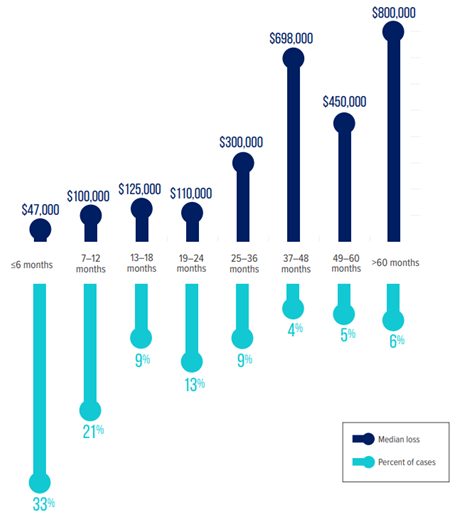

It is not surprising to see internal audit and data analytics as the big winners when it comes to combating fraud. Internal audits and management review functions were the source of 28% of the frauds detected. Many people view fraud as a discrete event, but they often occur over a period of time; according to the 2022 RTN, the median duration of a fraud scheme is 12 months. While organizations cannot prevent all instances of fraud, they can reduce the duration, thus decreasing the cost of the fraud.

How Does the Duration of Fraud Relate to Median Loss?

Automated transaction and data monitoring lead to the shortest duration and least median loss. Considering that 52% of the organizations in the report never recovered any of the losses from fraud, it is paramount to be able to detect and quickly shut down a fraud scheme once it starts.

Risk Assessment

There is no “one size fits all” approach to fraud controls within an organization. It is critical that organizations perform a risk assessment, so their anti-fraud controls are combatting the proper risk areas. Experts recommend that organizations deploy multiple controls in their defense against fraudsters.

One of the main reasons companies cut back on fraud prevention is because they cannot always see the benefits. The ACFE report helps demonstrate the value of investing in these controls. Most tellingly, implementation rates for 17 of the 18 analyzed fraud controls have increased over the last decade, at the same time the median duration and median losses of fraud have decreased. This is no coincidence; properly implemented and maintained fraud controls help prevent fraud.

Detecting and Combating Fraud

Assess. Design. Forensic experts have investigated and unraveled some of the most complex and notorious frauds of the last three decades. Are you confident in your organization’s current fraud controls? Are you unsure what controls you have in place or need? A risk assessment ‒ including cyber-security ‒ of your organization can be performed to prioritize areas for improvement and to make recommendations to help protect your organization.

Test. An outsourced internal audit performing periodic testing of transactions and fraud schemes within your organization can be performed. Internal audits were one of the most common methods by which frauds were initially detected. Financial statement audits, while beneficial, are not designed to detect fraud (in fact, only 4% of frauds were initially detected by an external audit).

Investigate. If your organization finds itself the victim of a suspected or known fraud, hire a firm that has the experience and expertise to assist in performing a fraud investigation. Our professionals have investigated a wide range of schemes including global corruption and accounting malfeasance. We are experienced working with in-house and external counsel on urgent matters and can provide the groundwork if the organization chooses to pursue civil or criminal action against the fraudsters.

Resolve. Remediate. Oftentimes, upon conclusion of the investigative phase, we are retained to assist with remediation procedures. We provide insight from a third-party perspective and leverage our extensive experience in remedial activities when working with the company’s board of directors, management team and external counsel to remediate concerns uncovered during the forensic phase.

Contact Us

If you would like to discuss how we can advise you on forensic financial matters, contact a member of your client service team or:

Jon Klerowski, CPA, CFE, ABV

Principal

781.937.5729 | jklerowski@pkfod.com

Brian McDonough, CPA, CFE

Manager

781.937.5362 | bmcdonough@pkfod.com

* About the Association of Certified Fraud Examiners Based in Austin, Texas, the ACFE is the world’s largest anti-fraud organization and premier provider of anti-fraud training and education. Together with more than 90,000 members, the ACFE is reducing business fraud worldwide and inspiring public confidence in the integrity and objectivity within the profession. For more information, visit ACFE.com Source of all data and charts: Occupational Fraud 2022: A Report to the Nations. Copyright 2022 by the Association of Certified Fraud Examiners, Inc. |