By Robert Murphy, Senior Managing Director

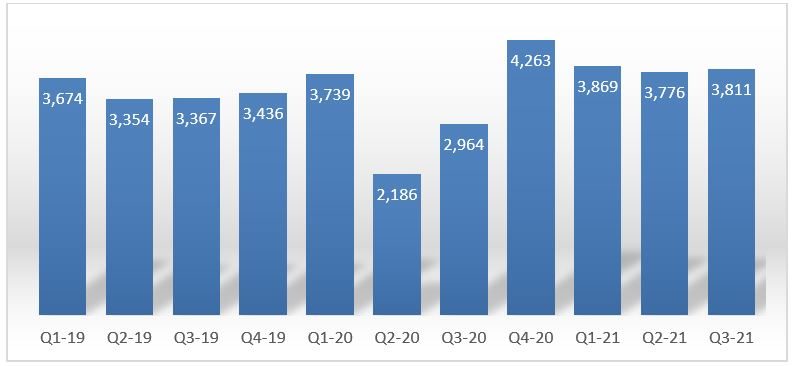

North American M&A deal activity remained robust in Q3 2021 following a strong H1 in 2021 and a record-breaking Q4 in 2020. YoY deal volume in Q3 increased 28.6% over Q3 2020. Through the first three quarters of 2021, deal volume is on pace to approximate or surpass record highs.

Closed M&A Deals in North America (Q1 2019 – Q3 2021)

Source: Pitchbook and PKF Investment Banking research.

The economic recovery is forging ahead despite inflationary pressures and global supply chain disruption, fueling unprecedented M&A activity. M&A activity across multiple sectors is being driven by digitalization and changes in business and consumer preferences due to COVID. As businesses reopen, travel reemerges, and equity markets continue to post broad gains, corporate executives and investors remain confident in a strong economic recovery.

Although the U.S. economy slowed in Q3 2021 with real GDP increasing at a modest 2%, 2021 is on track to achieve the highest annual GDP growth rate in almost four decades. Inexpensive financing, ample private equity dry powder, strong public company valuations, and diminishing economic uncertainty continue to encourage businesses and investors to grow through acquisition.

Transaction Multiples Reached Historical High

Average transaction multiples in Q3 2021 with Transaction Enterprise Values (TEV) of $10 million to $250 million increased to 7.6x, which was the highest quarterly mark in GF Data’s 16-year history. It again signals strong M&A momentum and transaction valuations, especially for companies that have performed well through COVID.

|

|

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

|---|---|---|---|---|---|---|---|

|

TEV/EBITDA |

7.3x |

7.3x |

6.6x |

6.8x |

7.0x |

7.2x |

7.6x |

|

Total Debt/EBITDA |

3.8x |

3.3x |

3.7x |

3.7x |

3.9x |

3.6x |

4.1x |

|

Senior Debt/EBITDA |

3.5x |

2.7x |

2.7x |

3.1x |

3.6x |

2.8x |

31.x |

Source: GF Data®

While valuations surged across the board, larger companies tended to receive higher valuation multiples. In the $100-$250 million TEV tier, the average was 9.8x. Buyers continued to favor companies with above-average TTM EBITDA margins and sales growth. In the past three quarters, above-average performers accounted for 62% of total reported transactions, while the historical average is 56%. These above-average performers were rewarded with a 28% valuation premium compared to below-average performers.One of the key factors contributing to higher multiples is the greater percentage of platform acquisitions, which tend to be valued higher than add-ons. This reverses a recent trend in favor of add-on deals. From 2018 to 2020, the platform percentage of total acquisitions ranged from 79.5% in 2018 to 70.0% in 2020. For the first nine months of 2021, the figure bounced back to 74.5%.

Quality Premium – Buyouts Only

|

|

2003-2016 |

2017 |

2018 |

2019 |

2020 |

YTD 2021 |

Total |

|---|---|---|---|---|---|---|---|

|

Above Average Financials |

6.4x |

7.8x |

7.8x |

7.5x |

7.7x |

7.8x |

6.9x |

|

Other Buyouts |

5.9x |

6.4x |

6.4x |

6.3x |

6.1x |

6.1x |

6.0x |

|

Premium (/Discount) |

109% |

122% |

123% |

120% |

127% |

128% |

115% |

|

Incidence |

56% |

56% |

59% |

52% |

55% |

62% |

56% |

Source: GF Data®

Debt Leverage Stabilized at Pre-COVID Levels in Q3 2021

Debt leverage has been steadily returning to pre-COVID levels since Q3 2020. Total debt in Q3 surged to 4.1x EBITDA, compared with 3.6x in Q2. The increase of leverage in Q3 is in line with increased valuation. For the first nine months of 2021, total debt averaged 3.9x, up from 3.7x in 2020 and reverted to the same level in 2019. Continued low interest rates across investment-grade and high-yield debt have boosted debt utilization to support M&A transactions.

The average debt leverage in Q3 2021 of 4.1x EBITDA comprised 3.1x senior debt and 1.0x subordinated debt, compared with 2.8x and .8x in Q2 2021, and 3.6x and .3x in Q1 2021, respectively. The lower percentage of senior debt usage reflects add-ons accounting for a lower percentage of the deals, as most add-ons are structured with all senior debt. GF Data noted that add-ons account for 24.5% of the sample transactions in YTD 2021, a drop from an unprecedented high of 30% in 2020.

Total Debt/EBITDA

|

TEV |

2003-2016 |

2017 |

2018 |

2019 |

2020 |

YTD 2021 |

Total |

N = |

|---|---|---|---|---|---|---|---|---|

|

10-25 |

3.2 |

3.9 |

3.4 |

3.8 |

3.6 |

3.8 |

3.4 |

1,339 |

|

25-50 |

3.5 |

3.9 |

3.6 |

3.9 |

3.4 |

3.8 |

3.6 |

1,091 |

|

50-100 |

3.7 |

4.3 |

4.1 |

3.9 |

3.6 |

3.8 |

3.8 |

748 |

|

100-250 |

4.3 |

4.7 |

4.8 |

4.4 |

4.7 |

4.3 |

4.4 |

409 |

|

|

|

|

|

|

|

|

|

|

|

Total |

3.5 |

4.1 |

3.8 |

3.9 |

3.7 |

3.9 |

3.6 |

|

|

N = |

2,292 |

237 |

270 |

284 |

275 |

229 |

|

3,587 |

Please note that N for 2003-2016 encompasses 14 years of activity.

Source: GF Data®

Outlook for Remainder of 2021

We are bullish on M&A activity during Q4 2021 and Q1 2022. The key M&A drivers remain intact, maintaining deal volumes and values at record levels. There are plenty of opportunities for value creation and growth. Highly sought-after deals that offer innovations and targets with outstanding performance are likely to continue to command a premium in this competitive market. However, recent increased COVID concerns, expected increases in interest rates and inflationary pressures could slow M&A activity at some point in 2022.

Anticipating an increase in capital gains tax in 2022, many buyers and sellers are racing to close deals in 2021. Consequently, Q4 2021 is expected to see a record level of M&A volume and transaction values ahead of potential capital gains tax hikes.

Contact Us

Robert Murphy

Senior Managing Director

rmurphy@pkfod.com

561.337.5324 | 201.788.6844