By John N. Vitucci, CPA, Partner

A large number of sponsors of employee stock ownership plans (ESOPs) are faced with complex issues relating to their rewards programs:

- Increasing repurchase obligations, recycling cost and a workforce with “haves and have nots”

- Changing workforce composition with a shrinking talent pool

- Outdated or underappreciated rewards programs

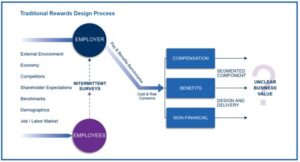

An ESOP approach can help companies design and implement rewards programs that motivate employees to do what it takes for the business to succeed. It can also be viewed as a process linking employee ownership, company spending on employment and other rewards costs to achieving business strategies.

An ESOP can transform a company’s total rewards expense from a “cost” to a measurable “strategic investment” by:

- Helping companies design and implement rewards programs that motivate employees to do what it takes for the business to succeed

- Enabling companies to deliver the rewards employees want and need to motivate them

- Customizing the organization’s business and talent strategy to align with its business objectives

- Providing the ability to seek continual feedback about employee ownership and rewards from employees

- Improving the ability to adjust rewards programs to business, economic and other environmental changes in a timely manner

- Providing the ability to measure and manage return on investment (ROI) rewards on an ongoing basis

Top 10 CEO Developmental Issues

- Sustained top-line growth

- Speed and flexibility to change

- Customer loyalty and retention

- Enabling entrepreneurship

- Ability to innovate

- Management of talent

- Cost management

- Succession planning

- Seizing expansion opportunities

- Knowledge transfer

Critical Talent

The issues CEOs are concerned about are at the heart of critical talent and encompass:

- The ability to innovate is driven by critical talent who cannot only predict the market, but also create it

- In a competitive disruptive market where loyalty is purchased, critical talent will move where they see the best opportunity to hone their skills

- The best managers create intentional networks to support critical talent

- Innovation and critical talent commitment derive from rich experiences, coaching, and training

- Critical talent can work across disciplines to thrive in climates of uncertainty

At the heart of ESOP and rewards optimization are four key concepts:

- Total rewards: all transactions between an employee and employer

- Critical workforce segments (CWS): focuses rewards investment on employees who can contribute the most business value in return

- Rewards dialogue: investigates employees’ views about — and probable reactions to — rewards

- ROI measurement and optimization: optimizes impact of total rewards programs on business performance

Effective Tools in ESOP and Rewards Optimization

- Optimize executive and critical workforce compensation

- Total Rewards Statement to communicate

- ESOP value

- Data analytics to understand workforce wants and needs

- Repurchase liability embedded with sustainability management of ESOP and repeatedly connected to valuation

- Build a holistic strategy, including business objectives and talent management for the near and long term

Focus: Executive Compensation

- Determine (and maximize) objectives for executive compensation related to Internal Revenue Code 409(p) and other constraints

- Coordination of qualified and non-qualified plans

- Interrelation of tax, legal, valuation and business issues

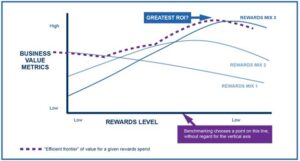

If we stop viewing employee rewards as a commodity cost, we can see more effective rewards design — and increases in rewards budgets — subject to the same ROI criteria as other business expenditures. For that purpose, we need both a ROI measurement methodology and predictive techniques for potential rewards “levels and mix.”

Contact Us

For more information on ESOPs, contact the PKF O’Connor Davies partner in charge of your client engagement or any of the following:

Timothy J. Desmond, CPA

Partner

551.249.1728 | tdesmond@pkfod.com

John N. Vitucci, CPA

Partner

917.841.8718 | jvitucci@pkfod.com

Ashley Pellegrino

Senior Associate

212.286.2600 | apellegrino@pkfod.com