By Gabriel G. Lengua, CPA, Partner

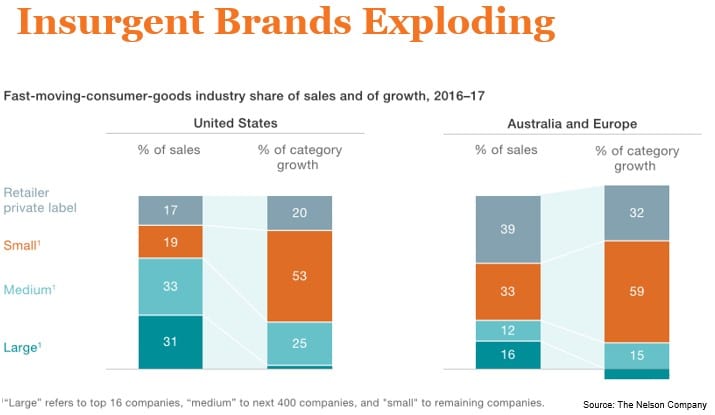

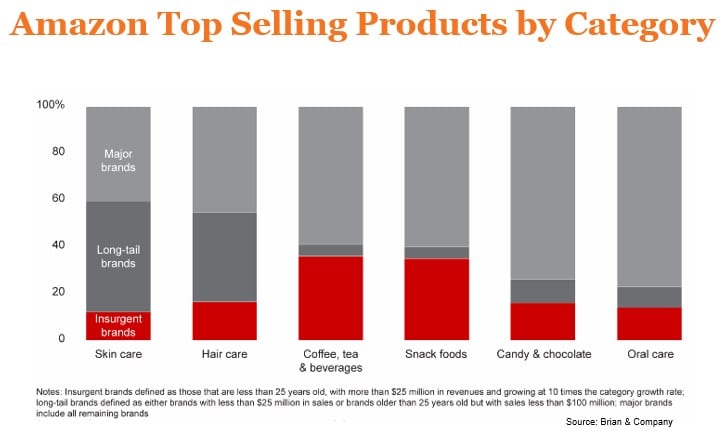

Harry’s, Halo Top, Justins, e.l.f. Cosmetics, KeVita – just to name a few. These are smaller brands that have carved out a nice niche for themselves. Just in case you haven’t noticed, insurgent brands have been gaining market share at a fast pace and have proven to be successful investments.

Why Invest in Insurgent Brands?

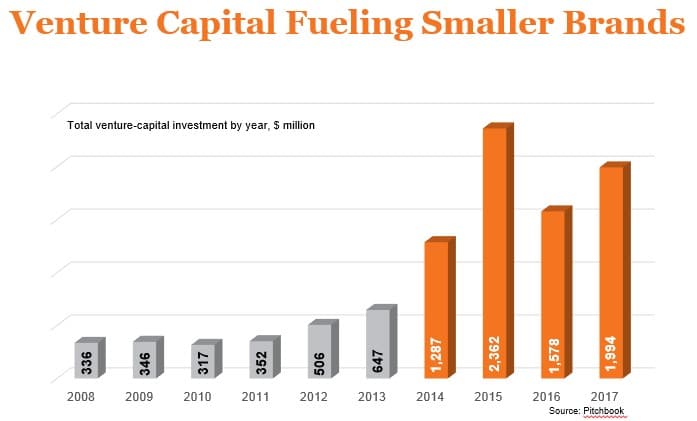

There are many reasons to consider insurgent brands as an attractive investment opportunity. They are gaining market share from larger brands because of their differentiation and focus on efficiency, creativity, and health and wellness. Retailers like them because it allows the retailer to stand out from the competition, and millennials seem to gravitate toward them. These brands also tend to have strong profit margins. Furthermore, insurgent brands are more nimble than larger brands, effectively using digital profiles and pivoting quickly when needed.

Then there is the economy. While there are some potential headwinds – higher interest rates being among them – we are seeing strong economic growth, a tight labor market and good wage growth. This has resulted in the highest consumer confidence we have seen in nearly 20 years and that, in turn, has resulted in a significant increase in consumer spending. For those that have the right business model, profits have been on the rise.

The Times They Are A-Changin’

From the changing face of the consumer (middle class growing, urbanization) to new patterns of personal consumption (increasing use of connected mobile devices) to technological advancements (AI and Big Data), the consumer goods landscape has gone through a number of changes in recent years.

To be competitive, companies need to be focused on unique experience, convenience, and personalization. What we have seen in recent years is insurgent brands tend to do these things better than their larger rivals. This has helped to make insurgent brands a force to deal with and something investors should pay attention to.

Contact Us

For more information about this article, please contact Gabe Lengua or a member of your PKF O’Connor Davies engagement team.

Gabe Lengua, CPA

Partner

glengua@pkfod.com | 646.449.6394