By Louis F. LiBrandi, EA, CEBS, ChFC, TGPC, Principal

Plan sponsors should review the cost of living adjustments (COLAs) to determine what, if any, changes need to be communicated to employees via orientation meetings and enrollment forms. In addition, the amounts may need to be updated and/or inputted into the payroll or other human resources information system used by the employer to monitor contributions made to an employee benefit plan.

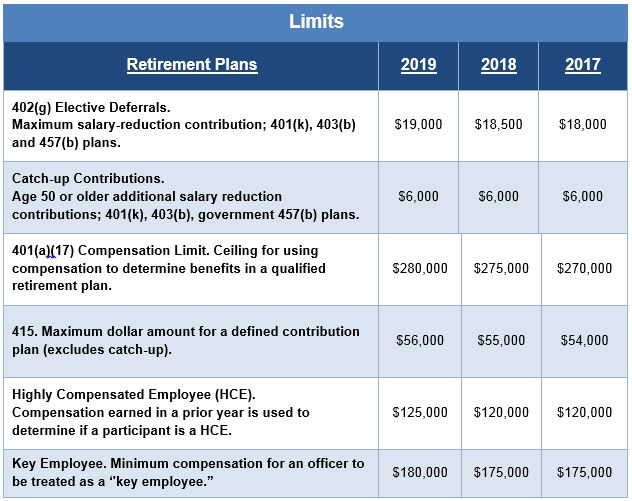

The table below contains the dollar limitation for retirement plans and other benefit plan limits and thresholds for the 2017 through 2019 tax years.

Contact Us

For more information or if you have any questions, contact your PKF O’Connor Davies representative or Louis F. LiBrandi, Principal at llibrandi@pkfod.com or 646.449.6327.