By Robert Murphy, Senior Managing Director and Susan Zhang, Vice President

2023 M&A Market Review

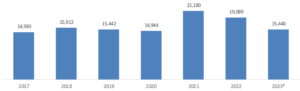

M&A activity in North America slowed in 2023, marking a departure from the unprecedented highs seen in 2021 and 2022. Deal closings in 2023 were more in line with pre-COVID levels, declining 19% to 15,440 from 19,089 in 2022, and notably lower than the height of 21,180 deals in 2021. U.S. PE middle-market buyout activity fell off by 27% in 2023.

Completed M&A Deals in North America (2017-2023)

Source: Pitchbook and PKF Investment Banking analysis

Note: Estimated based on deals reported through February 19, 2024

Higher interest rates, fears of a recession, persistent inflation, credit market tightening, geopolitical uncertainties and a dislocation in buyer/seller value expectations across many sectors have all contributed to the 2023 decline.

Higher interest rates were a primary driver of the 2023 slowdown, leading to higher borrowing costs and lower valuations. A tighter credit market and increased scrutiny from lenders reduced debt leverage to fund transactions, especially platform investments by private equity.

The collapse of several high-profile regional banks in early 2023, in addition to the above factors, furthered economic uncertainty with fears of a recession.

Since mid-2022, the combination of leverage buyout market tightening and economic uncertainty created a dislocation in buyer/seller value expectations. This misalignment resulted in a material decrease in private equity exits, further impacting the M&A landscape in 2023.

According to Pitchbook, 75.9% of PE buyout activity in 2023 were add-ons, which is a cost efficient way for PE firms to continue to deploy capital despite higher interest rates and economic uncertainty. Financing add-ons is typically more feasible due to their smaller size and the borrowing from existing credit facilities.

Earnouts and seller notes were effective tools in facilitating deal agreements as a result of tighter credit markets, valuation disconnect and economic uncertainty.

Optimism About the 2024 M&A Environment

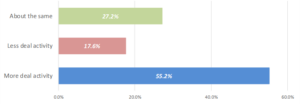

Dealmakers are optimistic about an improvement in the M&A environment. A survey by the ACG community revealed that 55% of respondents foresee an increase in deal activity in 2024, while 27% expect activity to remain in line with 2023. Only 18% anticipate a decline.

Middle-Market M&A Activity Outlook

Dealmakers weigh in on expectations for how 2024 will compare with 2023

Source: ACG’s 2024 Middle-Market Outlook Survey

The EY-Parthenon Deal Barometer forecasts a 13% rebound in U.S. PE deal volume in 2024, while anticipating a gradual increase in corporate M&A activity throughout the year with an average rise of 12% in 2024.

Drivers of M&A Activity in 2024

Driven by optimistic expectations for the U.S. economy and a decrease in market challenges, a rebound in M&A activity is anticipated in 2024 by the dealmaking community. Inflation, though still higher than the Fed’s target, has decreased and interest rates have stabilized with an expected gradual decline this year. Signs of improvement are evident in traditional credit markets, and private credit has become more widely available. Equity markets have also rebounded and reached new highs.

Expected Interest Rate Reductions Should Increase M&A Activity

Although rates are projected to remain constant for the first half of 2024, an ending to rate hikes supports a more favorable financing environment. Expected rate reductions are likely to fuel M&A activity in the second half of 2024.

Federal Funds Rate with Market Expectations

Source: Federal Reserve, CME Group. Geography: U.S.

Note: Federal Reserve data as of February 1st, 2024. The long-run equilibrium is based on the Fed’s latest Summary of Economic Projections.

Buyers’ Abundant Purchasing Power

Significant amounts of capital are available for acquisitions from sovereign wealth funds, family offices, PE and VC investors and corporations with strong balance sheets. According to S&P Global, global private equity dry powder has reached a record $2.59 trillion, up 8% since 2022. A growing level of dry powder has created pressure to utilize more capital as interest rates remain steady and are expected to decline.

Narrowing Price Gap

The disparity between seller and buyer expectations has contracted and is anticipated to further narrow during 2024. Nevertheless, the highest quality assets still command a premium valuation, reflecting the continued demand for “A” quality investments in the market.

Increase in PE Exit Activity

Firms are currently retaining portfolio companies longer than usual since the decline in PE exits in the early part of 2022; in the absence of attractive exit returns, PE firms shifted toward a more hands-on operational strategy, spending more time engaging with operating professionals to enhance the performance of their portfolio companies. With pressure on PE firms from limited partners to return capital and a more favorable exit market, an increase in PE exits in 2024 is expected.

U.S. PE Exit Activity

Source: PitchBook Geography: U.S.

Note: As of December 31, 2023

More Leverage Available in the Market

Alternative lenders now have more opportunities given the tighter traditional bank lending market over the past 20 months. There are many financing options available to accommodate the needs of acquirers. For example, the private credit market grew to approximately $1.4 trillion at the start of 2023, up from $875 billion in 2020. The market is projected to grow to $2.3 trillion by 2027, according to Morgan Stanley. We anticipate that private credit will continue to play a significant role for new deals in 2024.

Technology Is Anticipated to Increase M&A in Certain Sectors

The fast pace of technological advancements will compel certain companies to actively pursue acquisitions for the purpose of integrating new technologies into their operations to gain a competitive edge. This is expected to increase deal activity across various sectors, including artificial intelligence, health care and fintech.

Outlook 2024 – Increase in Activity Expected

Despite a generally positive outlook in deal activity for 2024, potential challenges could create headwinds for transaction activity as the year goes on. Ongoing conflicts in Ukraine and the Middle East, coupled with the unpredictability of the Fed’s future actions on interest rates and the 2024 presidential election, are key considerations for dealmakers.

We anticipate favorable M&A drivers will outweigh market challenges and lead to a modest increase in deal volume of 3% – 5% in 2024. We expect deal activity in the first half of 2024 to be in line with the last few quarters of 2023 and then increase during the second half of 2024.

Contact Us

- Robert Murphy

Senior Managing Director

PKF Investment Banking

rmurphy@pkfib.com | 561.337.5324 - Susan Zhang

Vice President

PKF Investment Banking

szhang@pkfib.com | 201.639.5739

About PKF Investment Banking

PKF O’Connor Davies Capital LLC (DBA PKF Investment Banking) is the investment banking affiliate of PKF O’Connor Davies. PKF O’Connor Davies Advisory LLC is a member firm of the PKF International Limited network of legally independent firms and does not accept any responsibility or liability for the actions or inactions on the part of any other individual member firm or firms.

The PKF Investment Banking team has completed over 250 M&A advisory and capital raise engagements in North America and abroad. Companies and business owners across a range of industries rely on our transaction and sector expertise, global reach, confidentiality and utmost integrity to help them achieve their objectives. We focus on privately held companies and have extensive knowledge with decades of experience advising middle-market businesses. Our key services include sell-side and buy-side M&A advisory, exit readiness and transaction planning.

Disclaimer

PKF Investment Banking provides this report for information purposes only and it does not constitute the provision of financial, legal or tax advice or accounting or professional consulting services of any kind. Securities-related transactions are processed through an unaffiliated broker-dealer, Burch & Company, Inc.