CARES Act – Provider Relief Fund

By Vincent Abbruzzese, CPA, Laurie Hafner, CPA, and Julie A. Williams, MPH

For health care providers laboring around the clock during the pandemic, financial relief is both welcome and well deserved. To give hospitals and other providers a much-needed cash flow boost, the Provider Relief Fund (PRF) was created as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The provision allocated $175 billion to the U.S. Department of Health and Human Services (HHS) to distribute to hospitals and healthcare providers battling the coronavirus.

There are complex requirements regarding how funds may be used, how to meet associated terms and conditions, whether and how funds must be returned as well as overall reporting documentation. For those already entrenched in managing front line efforts, compliance can be a serious challenge. Our specialists are poised to assist providers in fulfilling government requirements – beginning with the following clarifications of PRF provisions.

Allocation of Funds

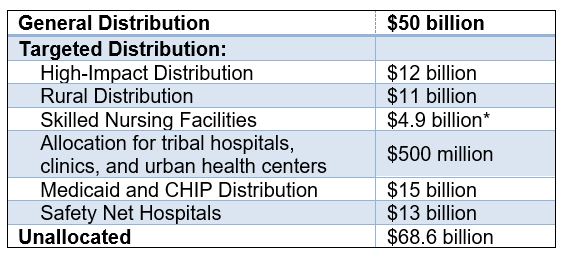

The PRF contains a broad general distribution as well as targeted distributions to specific providers and facilities. The funds are to be directed as follows:

*HHS announced July 22 that an additional $5 billion will be released to skilled nursing facilities

General Distribution

All facilities and providers that received Medicare fee-for-service (FFS) payments in 2019 are eligible for the general distribution. The initial distribution of $30 billion was allocated based on a provider’s share of Medicare FFS reimbursements in 2018. The remaining $20 billion was allocated based on Centers for Medicare & Medicaid (CMS) cost reports or incurred losses.

The allocation methodology is designed to provide relief to providers who bill Medicare fee-for-service, with at least 2% of that provider’s net patient revenue, regardless of the provider’s payer mix. Payments are determined based on the lesser of 2% of a provider’s 2018 (or most recent complete tax year) net patient revenue or the sum of incurred losses for March and April.

The deadline for providers to submit revenue information and apply for a portion of the additional $20 Billion General Distribution funding was June 3, 2020. Providers who ceased operations as a result of the COVID-19 pandemic are eligible to receive funds as long as they provided diagnoses, testing, or care for individuals with possible or actual cases of COVID-19. Care does not have to be specific to treating COVID-19. HHS broadly views every patient as a possible case of COVID-19.

Targeted Distributions

High-Impact Distribution – hospitals that had 100 or more COVID-19 admissions between January 1 and April 10 are eligible to receive a distribution. $10 billion of the available funds will be allocated based on number of admission multiplied by $76,975. The remaining $2 billion to be allocated based on high-impact hospitals with Medicare disproportionate share.

Rural Distribution – Rural acute care hospitals and critical access hospitals, independent rural health clinics and community health center sites located in rural areas are eligible to receive a distribution, which is calculated based on operating expense and type of facility. There are certain geographical requirements for a provider or facility to be considered in a rural area.

Skilled Nursing Facilities (SNFs) – Certified SNFs with six or more certified beds are eligible to receive a distribution. The distribution is calculated based on a fixed payment of $50,000 plus $2,500 per Certified Bed.

Allocation for Tribal Hospitals, Clinics, and Urban Health Centers – Indian Health Service (IHS) and tribal hospitals, IHS and tribal clinics and programs, and IHS urban programs are eligible to receive a distribution, which is calculated based on operating expense.

Medicaid and CHIP Distribution – Providers who did not receive funds from the General Distribution and billed Medicaid/CHIP programs or Medicaid managed care plans for healthcare-related services from January 1 to May 31 are eligible to receive this distribution.

Allocation for Safety Net Hospitals – Hospitals with Medicare Disproportionate Payment Percentage (DPP) of 20.2% or greater, average uncompensated care per bed of $25,000 or more, and profitability of 3% or less are eligible to receive this distribution.

Allocation for Uninsured Patients – A portion of the funds are also distributed to providers who serve uninsured individuals based on COVID-19-related testing and treatment provided on or after February 4, 2020. Providers and facilities are allowed to request claims for reimbursement and, subject to available funds, will be reimbursed at Medicare rates.

Use of Funds Received

There are specific terms and conditions for each of the distribution allocations mentioned above. The terms and conditions place restrictions on how the funds can be used. Recipients will be required to substantiate that the funds were:

- Used for increased healthcare-related expenses, or

- To supplement lost revenue attributable to the coronavirus, and

- That those expenses or losses were not reimbursed from other sources and other sources were not obligated to reimburse them.

“Healthcare related expenses,” broadly defined, encompasses a range of items and services purchased to prevent, prepare for, and respond to coronavirus; the following is a list of examples included on the HHS website:

- Supplies used to provide healthcare services for possible or actual COVID-19 patients;

- Equipment used to provide healthcare services for possible or actual COVID-19 patients;

- Workforce training;

- Developing and staffing emergency operation centers;

- Reporting COVID-19 test results to federal, state, or local governments;

- Building or constructing temporary structures to expand capacity for COVID-19 patient care or to provide healthcare services to non-COVID-19 patients in a separate area from where COVID-19 patients are being treated; and

- Acquiring additional resources, including facilities, equipment, supplies, healthcare practices, staffing, and technology to expand or preserve care delivery.

Providers can use the funds for eligible health care related expenses incurred prior to the date on which they received their payment as long as those expenses were attributable to coronavirus and were used to prevent, prepare for, and respond to coronavirus. HHS has stated that it would be highly unusual for providers to have incurred eligible expenses prior to January 1, 2020.

“Lost revenues that are attributable to Coronavirus” means any income that a healthcare provider did not collect as a direct result of the coronavirus and may include:

- Revenue losses associated with fewer outpatient visits;

- Canceled elective procedures or services, or

- Increased uncompensated care.

Providers can use the funds to cover any cost that the lost revenue otherwise would have covered, so long as that cost prevents, prepares for, or responds to coronavirus. Thus, these costs do not need to be specific to providing care for possible or actual coronavirus patients, but the lost revenue that the PRF payment covers must have been lost due to coronavirus. A healthcare provider must use a reasonable method of estimating the revenue during March and April 2020 compared to the same period had COVID-19 not appeared. For example, if you have a budget prepared without taking into account the impact of COVID-19, the estimated lost revenue could be the difference between your budgeted revenue and actual revenue. It would also be reasonable to compare the revenues to the same period last year.

HHS will undertake significant anti-fraud monitoring of the funds distributed, and the Office of Inspector General will provide oversight as required in the CARES Act to ensure that Federal dollars are used appropriately. All records pertaining to expenditures associated with the PRF payment must be retained for three years from the date of the final expenditure.

Return of Funds Not Used

If, at the conclusion of the pandemic, providers have leftover PRF money that they cannot spend on permissible expenses or losses, then they are required to return this money to HHS. Generally, HHS does not intend to recoup funds as long as a provider’s lost revenue and increased expenses exceed the amount of Provider Relief funding received. HHS expects that providers will use PRF payments for only as long as they have eligible expenses or lost revenue. HHS will provide directions in the future about how to return unused funds. HHS reserves the right to audit PRF recipients in the future and collect any Relief Fund amounts that were used inappropriately. HHS has not yet detailed how recoupment or repayment will work.

Reporting Requirements

Any provider or facility that receives funds must sign an attestation confirming receipt of the funds and agreeing to the terms and conditions of payment within 90 days of receiving the payment. Not returning the payment within 90 days of receipt will be viewed as acceptance of the terms and conditions. In addition to agreeing to the terms and conditions, providers that received funds must provide HHS with an accounting of their annual revenues by submitting tax returns or financial statements. The accounting information will also be used as an application for additional funding.

Any provider that receives, in the aggregate, $150,000 or more from any statute that derived from the CARES Act will be required to report to HHS and the Pandemic Response Accountability Committee. In addition, providers that received one or more payments exceeding $10,000 from the PRF will need to meet the additional reporting requirement. The content and due date(s) of the reports required are expected to be released by August 17, 2020. Providers are expected to be required to submit documents sufficient to ensure that the funds were used for healthcare-related expenses or lost revenue attributable to the coronavirus and in accordance with the terms and conditions of each distribution. The reporting system will become available to recipients October 1, 2020. Recipients must report within 45 days of the end of calendar year 2020 on expenditures through the period ended December 31, 2020. If funds received have been used in full by December 31, 2020, a recipient may submit a single final report any time between October 1, 2020 and no later than February 15, 2021. For recipients that had unused funds after December 31, 2020, a second and final report will need to be submitted no later than July 31, 2021.

HHS has reserved the right to audit providers that received funds. It’s imperative that recipients adhere to the terms and conditions of the distributions and also of equal importance is the fact that certain circumstances may arise in which some of the unused funds will need to be returned to HHS and, therefore, providers need to plan accordingly.

General Information

No “surprise billing” ‒ Providers must not seek collection of out-of-pocket payments from a presumptive or actual COVID-19 patient that are greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network provider.

Insurance protections – Providers must not seek collection of out-of-pocket payments from a presumptive or actual COVID-19 patient that are greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network provider.

Additional information, including FAQs and terms and conditions, can be found at the HHS website. Further guidance regarding unallocated funds and reporting requirements is expected within the coming weeks, and we will provide updates as these are forthcoming.

Contact Us

If you require assistance understanding any of the terms and conditions of the Cares Act Provider Relief Fund, please contact the partner in charge of your account or:

Laurie Hafner, CPA | Christopher J. McCarthy, CPA |

Dorothea A. Russo, CPA | Keith Solomon, CPA |

Julie A. Williams, MPH | Vincent Abbruzzese, CPA |